alaska sales tax on services

There are however several municipal governments that do. The two largest cities Anchorage and Fairbanks do not charge a local sales tax.

Use Tax Is Sort Of Like The Evil Twin Of Sales Tax But Each Of These Taxes Work Differently Use Tax Is A Type Types Of Sales Bookkeeping Creative Business

You can access this local contact information through the Division of Community and Regional.

. Free Unlimited Searches Try Now. The Commission is comprised of. Localities that may impose additional sales taxes include counties cities and special districts like transportation districts and special business zones.

Out of state sales tax nexus in Alaska can be triggered in a number of ways. With local taxes the total. The state sales tax rate in Alaska is reviewed on a monthly basis for proposed modifications and when those changes would take effect.

For sales taxes they are required to be added to the sales. While Anchorage and Fairbanks the two largest cities in Alaska do not charge sales tax Juneau for example charges a local sales tax rate of 5. Below you will find a.

This lookup tool is provided by the Alaska Remote Seller Sales Tax Commission ARSSTC. Alaska Taxable 2020 Full Report. There are few exceptions to the application of sales tax and it is the responsibility of the seller to be informed about the taxation of the sale.

Instead the state recently passed legislation allowing local jurisdictions to elect to require that eCommerce businesses with economic nexus to. Alaska Sales Tax. Alaska has a destination-based sales tax system so you have to pay attention to the varying tax rates across the state.

While Anchorage and Fairbanks the two largest cities in Alaska do not charge sales tax. The State of Alaska does not levy a sales tax. Higher rates are found in locations that lack a property tax.

Local taxing authoritieslike cities and boroughsparticipate in ARSSTC to share their local sales tax rates and taxability information through this portal. Therefore if you are a business entity subject to sales taxes within the state you will need to contact the local municipal government for their particular sales tax regulations and forms. Unlike the other US States and Washington DC that have a sales tax Alaska does not have a statewide sales tax.

Alaska is one of the five states in the USA that have no state sales tax. State Substitute Form W-9 - Requesting Taxpayer ID Info. Wayfair decision local governments in Alaska signed an intergovernmental agreement to establish the Alaska Remote Sellers Sales Tax Commission.

In reaction to the 2018 South Dakota v. Individual municipalities have wide authority to set their own taxation rates and sales tax can be as high as 75. Alaska Provides Guidance on Sales Tax for Remote Sales.

While there is no state sales tax in Alaska boroughs and municipalities are allowed to collect local sales taxes within their jurisdictions. The City of Adak levies a sales and use tax of on all sales rents and services made in the city at the rate of 4. Sales Tax is collected on the first 50000 of a sale creating a 1250 tax cap per transaction.

The Code requires remote sellers and marketplace facilitators to register with the commission and collect and remit the tax on their sales into member Alaska localities if the sellers or facilitators have 100000 or more in annual gross receipts from sales or 200 or more sales annually into the state. Alaska is one of five states with no state sales tax. In Alaska localities are allowed to collect local sales taxes of up to 700in addition to the Alaska state sales tax.

Localities within Alaska however do have sales tax. And as many Alaskans can confirm sales tax has been alive and well for many years. Skip to main content.

The Alaska Remote Seller Sales Tax Commission provided information on what types of charges are in the sales price for a remote sale. District of Columbia State of Alaska Sales Tax Exemption PDF Tax Information. To experience these reports to their fullest it is recommended that a Google Chrome or Firefox browser be used.

State of Alaska Department of Revenue For corrections or if any link or information is inaccurate or otherwise out-dated please email The Webmaster. However many of its municipalities do impose a sales. Individual towns have broad discretion over tax rates and sales taxes can be as high as 75 percent.

The City of Wasilla collects a 25 sales tax on all sales services and rentals within the City unless exempt by WMC 516050 see the Sales Tax Exemption page for information about exemptions. The state-wide sales tax in Alaska is 0. Welcome to the Alaska Sales Tax Lookup.

There are additional levels of sales tax at local jurisdictions too. State Office Building 333. State of Alaska Department Administration Division of Finance.

Remote Seller Filing is Available for Participating Local. The current statewide sales tax rate in Alaska AK is 0. Alaska Taxable 2021 Full Report.

Transaction data insights for manufacturing retail and services sectors. Total Sales Tax Rate State Rate County Rate City Rate District Rate Special Taxation District. In addition to the Alaska Taxable publication an interactive report containing some tax and revenue data is available here.

The state capital Juneau has a 5 percent sales tax rate. And travel services for State government. While there is no state sales tax in Alaska boroughs and municipalities are allowed to collect local sales taxes within their jurisdictions.

Alaska is unique because it does not have a state sales tax which means their State Rate is equal to 0. However localities can levy sales taxes which can reach 75. 31 rows The state sales tax rate in Alaska is 0000.

Alaska sales tax is monitored on a monthly basis for proposed changes to the state sales tax rate and when tax rate changes will take effect. Alaska doesnt assess statewide sales taxes nor an individual income state tax. The Alaska AK statewide sales tax rate is currently 0.

Charge the tax rate of the buyers address as thats the destination of your product or service. The Alaska state sales tax rate is 0 and the average AK sales tax after local surtaxes is 176. Sales tax is remitted monthly by the seller on tax return forms provided by the City.

Sales price is defined as the amount of consideration exchanged between the seller and the buyer. Ad Lookup AK Sales Tax Rates By Zip. Understand how your online business can be exposed to tax risk.

155 South Seward Street City Hall Room 106 Juneau AK.

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Amazon Tax Vs Existing State Use Taxes American History Timeline Accounting Services Tax

Louisiana Sales Tax Small Business Guide Truic

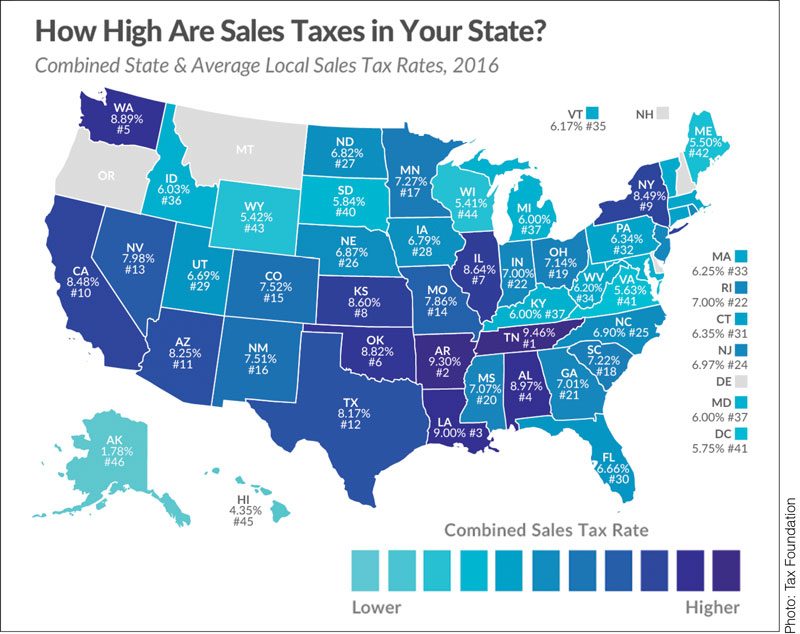

States With Highest And Lowest Sales Tax Rates

.png)

States Sales Taxes On Software Tax Foundation

Why Hb 1628 S Sales Tax On Services Is Bad For Maryland Maryland Association Of Cpas Macpa

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Tax Definition What Is A Sales Tax Tax Edu

Where Are All Amazon Fulfillment Centers Amazon Fulfillment Center Make Money On Amazon Us Map

Sales Tax By State Is Saas Taxable Taxjar

Sales Allocation Methods The Cpa Journal Method Journal Cpa

When Did Your State Adopt Its Sales Tax Tax Foundation

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Avoid Penalties By Staying Aware Of Sales Tax Laws

U S States With No Sales Tax Taxjar

How Do State And Local Sales Taxes Work Tax Policy Center

States Without Sales Tax Article

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)