vermont sales tax exemptions

Vermonts Sales Tax Home Page Vermonts Sales Tax Statutes Vermonts Sales Tax Regulations Identify the purpose use and location of manufacturing purchases which is an important. Ad Avalara experts provide information to help you stay on top of tax compliance.

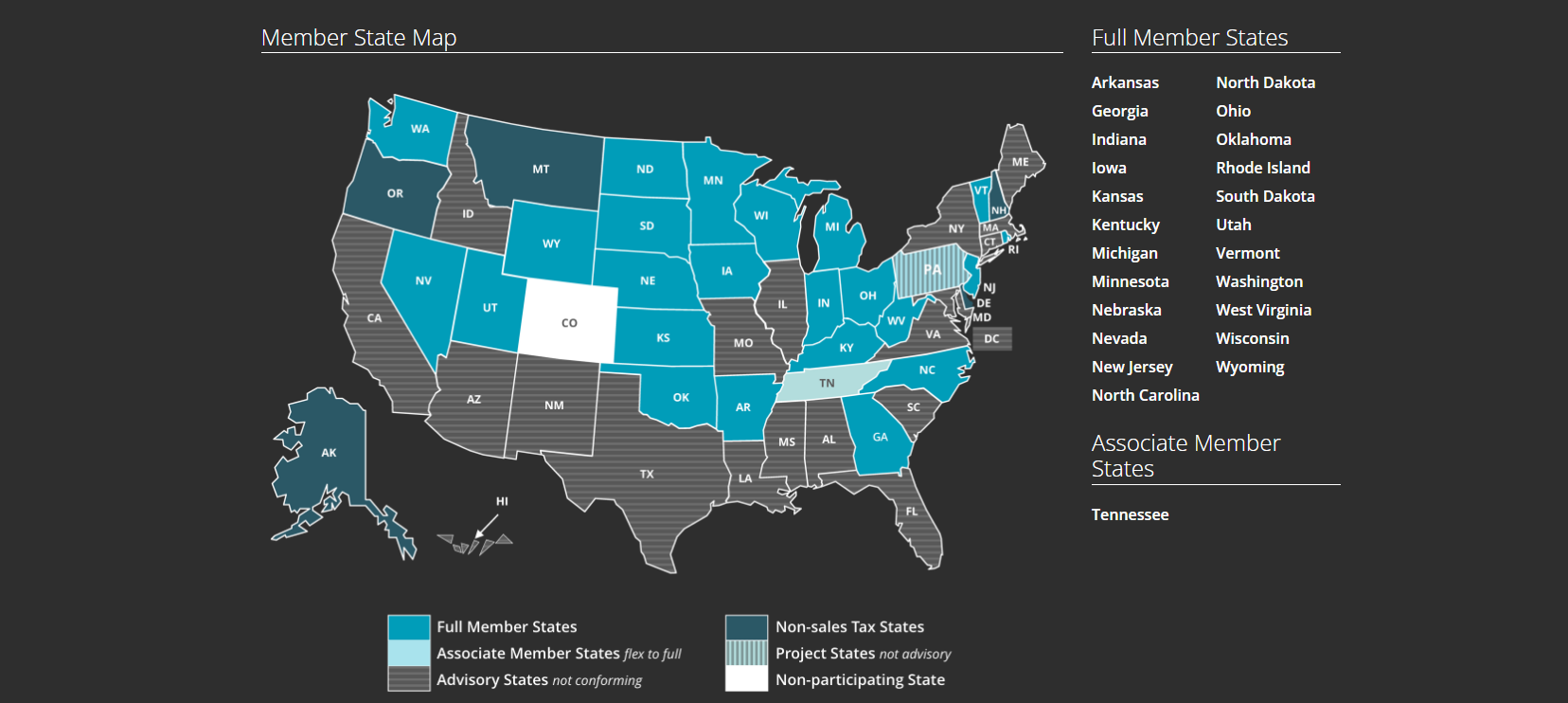

Streamlined Sales Tax Free Online Sales Tax Solution Ledgergurus

Groceries clothing prescription drugs and non-prescription drugs are exempt from the.

. Present sales use tax exemption form for exemption from state hotel tax. The state of Vermont levies a 6 state sales tax on the retail sale lease or. Manufacturers and industrial processors with facilities located in Vermont may be eligible for a utility tax exemption.

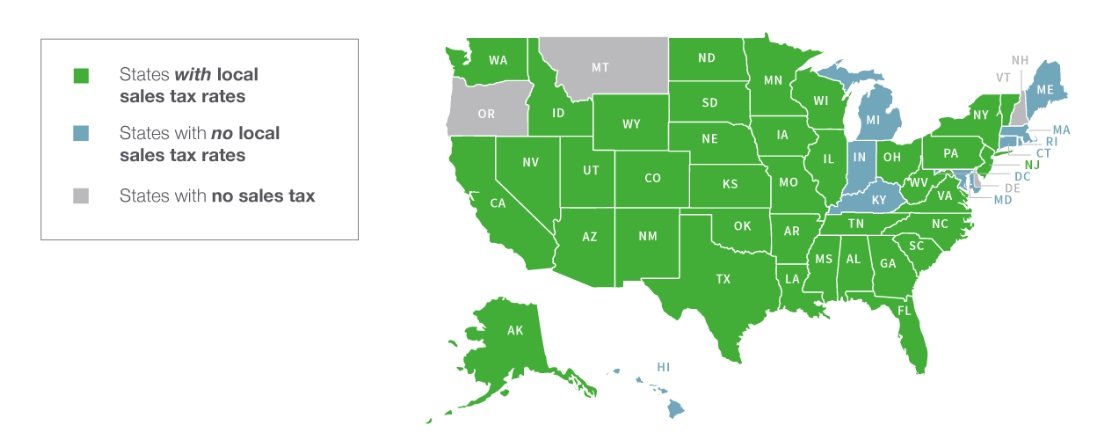

Ad Fill out a simple online application now and receive yours in under 5 days. Local jurisdictions can impose additional sales taxes of 1. In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

The state of Vermont levies a 6 state sales tax on the retail sale lease or rental of most goods and some services. 9701 and Vermont Sales and Use Tax Regulations 19741 2 except for items specifically exempted. State of Vermont Attached is a copy of the Resale and Exempt Organization Certificate of Exemption for the state of Vermont.

2 Food food products and beverages are exempt. As a business owner selling taxable goods or services you act as an agent of the. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614.

South Carolina SC x No. S tep 2 Check whether the. An example of items that are exempt from Vermont sales.

How to use sales tax exemption certificates in Vermont. Printable Vermont Sales Tax Exemption Certificates Managing sales tax exemption certificates is a challenge for any. Medical Equipment Supplies Exempt Supplies Taxable Food Food Products and Beverages Exempt Food food products and beverages are exempt from Vermont Sales and Use Tax.

Ad Fill out a simple online application now and receive yours in under 5 days. Steps for filling out the S-3 Vermont Certificate of Exemption. 53 rows Exemption extends to sales tax levied on purchases of restaurant meals.

While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Ad Avalara experts provide information to help you stay on top of tax compliance. While the Vermont sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

This table lists each changed tax jurisdiction the amount of the change. All tangible personal property is taxable as specified in Vermont statute 32 VSA. A retailers sale of glucose test strips lancing devices and lancets are exempt from Vermont sales and use tax since they were used in medical diagnosis or treatment.

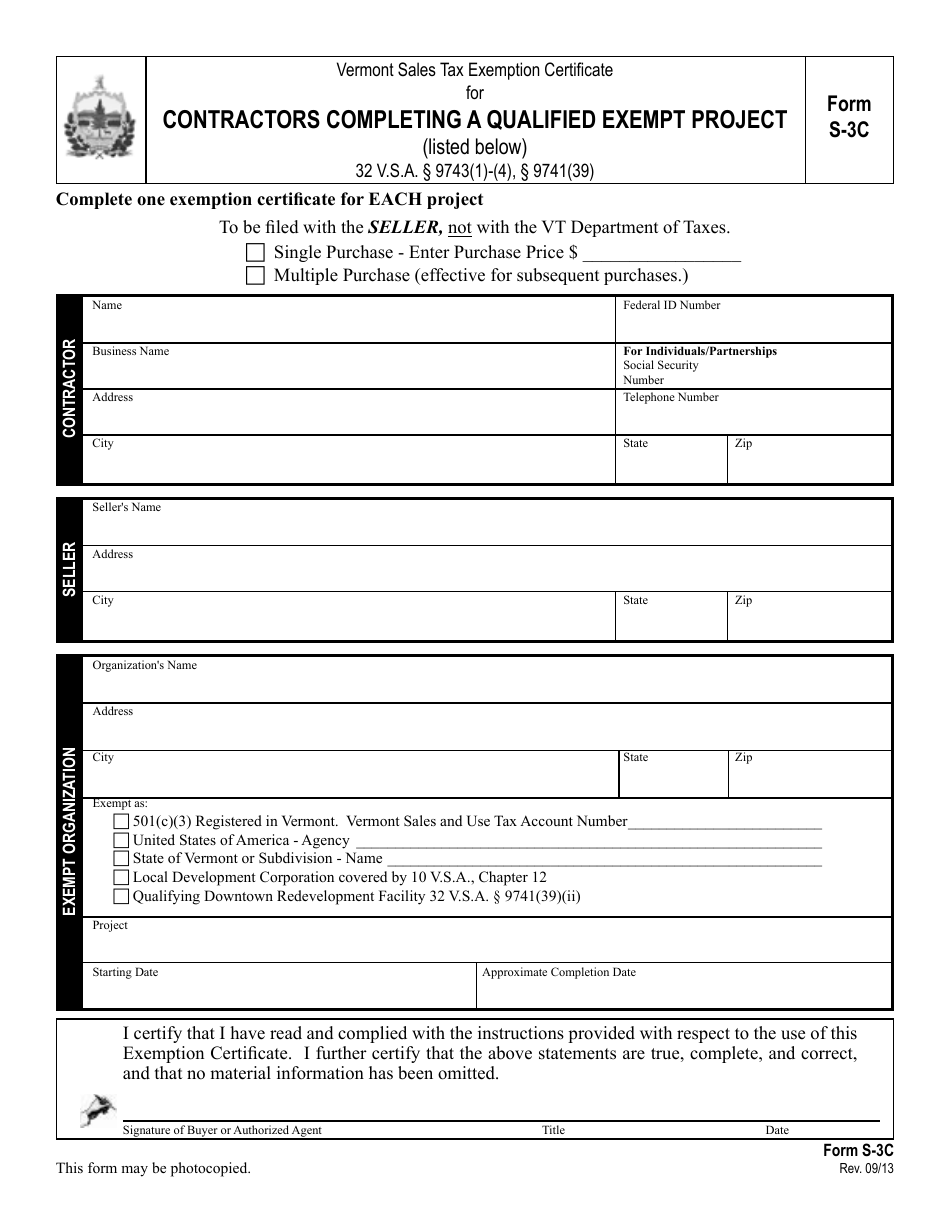

Wednesday March 16 2022 - 1200. Including industry updates new tax laws and some long-term effects of recent events. Vermont Sales Tax Exemption Certificate For Purchases For Resale By Exempt Organizations And By Direct Pay Permit.

Vermont offers an exemption from state and local sales tax on the. 10 rows Vermont Sales Tax Exemption Certificate for Agricultural Fertilizers Pesticides Machinery. Including industry updates new tax laws and some long-term effects of recent events.

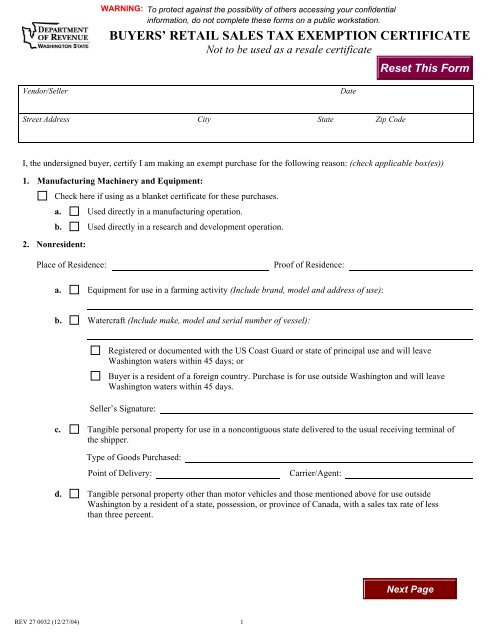

To obtain exemption from sales taxes this form must be. 2022 Vermont Sales Tax Changes Over the past year there have been one local sales tax rate changes in Vermont. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0156 for a total of 6156 when.

A copy of Exemption Organization Registration Certificate for Vermont Sales and Use Tax or a letter from the Vermont Department of Taxes signed by the Tax Department stating that the. This page discusses various sales tax exemptions in Vermont. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

This page describes the taxability of. Step 1 Begin by downloading the Vermont Certificate of Exemption Form S-3. Currently combined sales tax rates in Vermont range from 6 to 7 depending on the location of the sale.

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting

Concentration Of Millennials In The Us Map United States Map Fun Facts

Vermont Sales Tax Information Sales Tax Rates And Deadlines

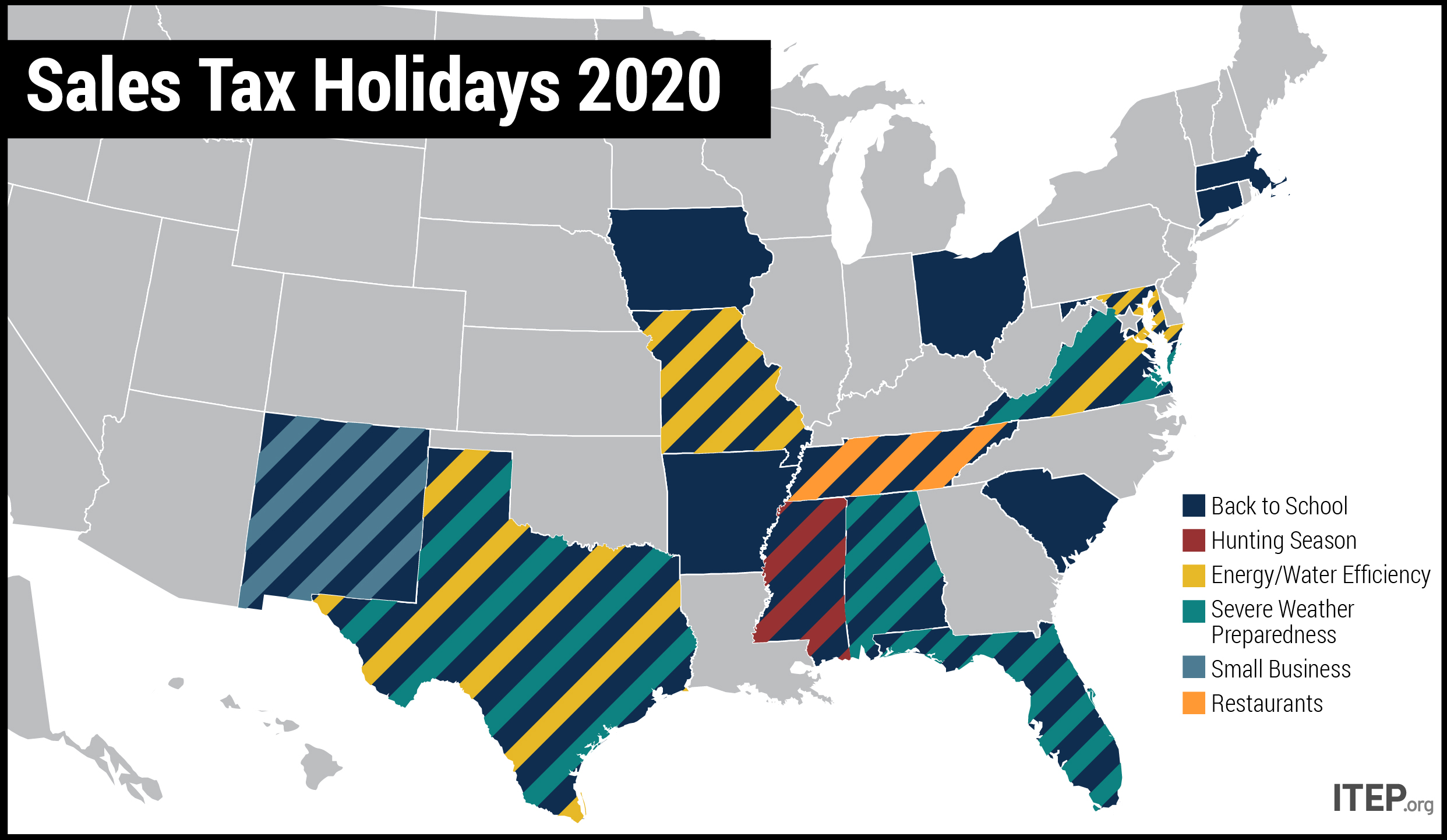

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Push Is On To Expand Vt Sales Tax To Services Ethan Allen Institute

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With Highest And Lowest Sales Tax Rates

Sales Taxes In The United States Wikiwand

Printable Vermont Sales Tax Exemption Certificates

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting

States Without Sales Tax Article

Sales Tax Collection Requirements For Us Sellers And 7 Steps To Ensuring Compliance

Sales Tax By State Is Saas Taxable Taxjar